Note: Below is the text of an email sent by LCCEA President Adrienne Mitchell to the LCC Board of Education on Sunday. It outlines additional budget information about the college for Board consideration, in advance of LCC’s Board of Education meeting on Tuesday, September 30, at 6 pm in Building 3, Room 216, on LCC’s Main Campus.

September 28, 2025

Esteemed Board of Education Members,

As promised, I am writing to share additional information with you.

LCC has three primary revenue sources: tuition, state funding, and property taxes – all of which are up and continue on an upward trajectory with revenue exceeding expenses.

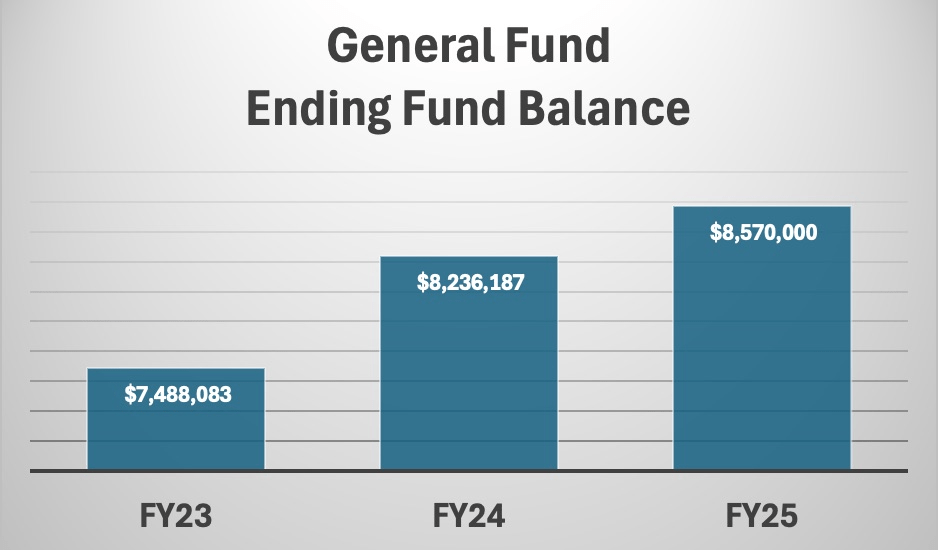

This bears out in the growing reserves of the ending fund balance. The FY23 and FY24 figures come directly from the official audit statements linked, and the FY25 estimate was provided by the administrators of the Budget and Finance offices (Fig. 1). These data from the external auditors and the Administration confirm that there is no structural deficit because revenues exceed expenses resulting in growth of reserves.

The budget development process for FY27 has not yet begun, nor have the steps that are required by Oregon Public budget law for FY27, let alone future years.

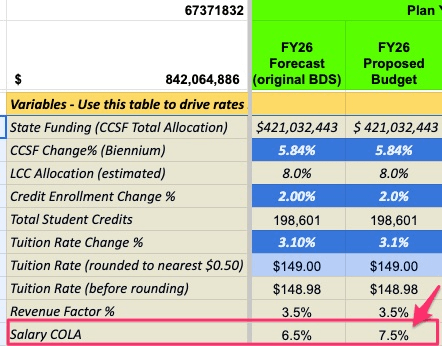

This year’s budget (i.e., FY26) had been balanced by the Budget Development Subcommittee and approved unanimously by the College Council, including students, stakeholders, and all top ranking administrators in voting positions. Even though it was approved unanimously, the Administration presented a different budget to the Board and its Budget Committee in May, making numerous changes, some of which are especially impactful in exaggerating expense estimates. For instance, the Administration changed the COLA (i.e., cost of living adjustment AKA salary schedule increase) built into the budget by increasing it from 6.5% to 7.5% for all employee groups, which added pressure to the budget and resulted in the call to cut $675,000 from the budget, which the Board did approve in June. You can see this increase in the Budget and Finance Office’s own forecasting model, a screenshot of which is below showing the change (Fig. 2).

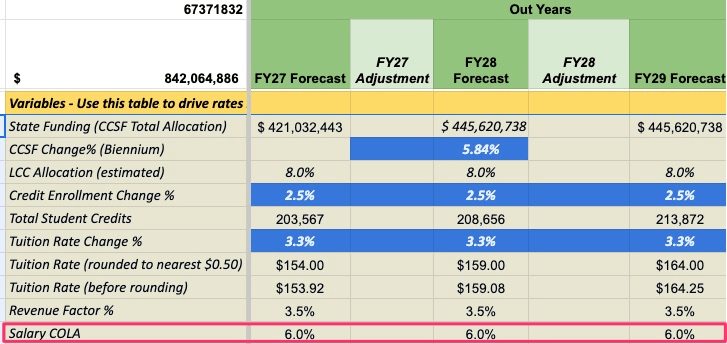

In addition, budget forecasts for multiple future years build substantial COLAs for all employee groups into each year. These compound to significantly overestimate future expenses. Please see below for another screenshot of the Administration’s own forecasting tool showing 6% COLAS built into each and every year for the next three years (Fig. 3).

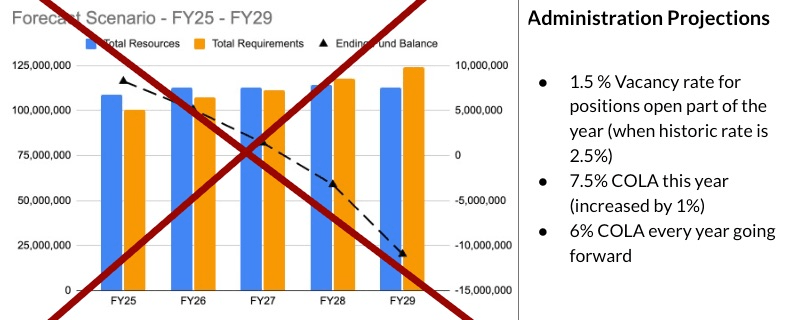

Please note that these COLA figures are merely one example of the assumptions that create an impression of future budget deficits. Other features built into the forecasts that contribute to exaggerated expenses include a vacancy rate set lower than the historic average, among others. It is the use of these unrealistic assumptions that create the forecast of decreasing ending fund balances (i.e. black dotted line), which you can see in the chart below from the Administration’s model (Fig. 4).

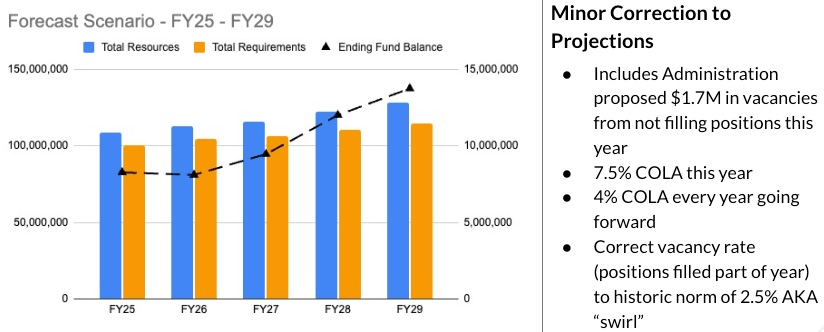

However, if one makes the most minimal adjustments such as including the $1.7M in vacancies the Administration stated on September 3 they will build into this year’ s budget and using 4% as a placeholder figure for COLAs for future years, even while maintaining the Administration’s 7.5% COLA figure for this year, the trajectory is positive, exceeding board policy requirements. Please see the chart below, again utilizing the Administration’s own modeling tool, showing growing reserves with revenue exceeding expenses each year (Fig. 5).

And furthermore with the application of the norm for the vacancy rate (i.e., 2.5% AKA “swirl”), the Administration’s forecasting tool shows a substantial increase to reserves, far and above the Ending Fund Balance policy requirement. Please see chart below (Fig. 6).

Approving a request by the Administration to make unknown cuts to next year’s budget as well as multiple future years’ budgets raises questions about adherence to state statutes, including public budget law, as well as numerous Board policies (e.g., 6105, 6110 , 6200, 6205 among others). This contravenes the public interest and will further undermine public trust in the institution.

Finally, in order to fulfill your fiduciary responsibility, at the future time when the budget development process does begin and the Board follows all legally-required steps such as formation of the Budget Committee, public hearings, etc., I encourage you to carefully review the assumptions upon which any future year’s forecasts are made.

In the meantime, I urge you to refrain from approving the President’s goal of budget cuts each year for the next three years’ budgets when the budget development process for FY27 has not yet even begun and to consider ways that the Board can ensure compliance with public budget and open meeting laws.

Thank you for your consideration and, as always, for your service to the people of Lane County.

Sincerely,

Adrienne